Peace of Mind is just a Click Away

FinSpot.guide may earn a commission when a user completes an action using our links, which will however not affect the review but might affect the rankings. The latter is determined on the basis of product market fit and compensation received.

The information contained in FinSpot.guide should not be conceived as legal, financial or investment advice nor as an endorsement of any of the products or services referenced in FinSpot.guide. As disclosed in the Terms and Conditions all information on FinSpot.guide is subject to change. FinSpot.guide does not contain an exhaustive list of all lending or insurance partners in each category.

- APHW’s base coverage protects appliances and systems all around your home

- Our home warranties are designed for a wide range of property types

- Get the coverage you need to keep your home running smoothly without the stress of expensive repairs

- We cover car repairs so that when mechanical breakdowns happen - you are worry free

- Your coverage includes parts, labor, towing, rental car, roadside assistance and more

- We have you covered. Get your instant quote now!

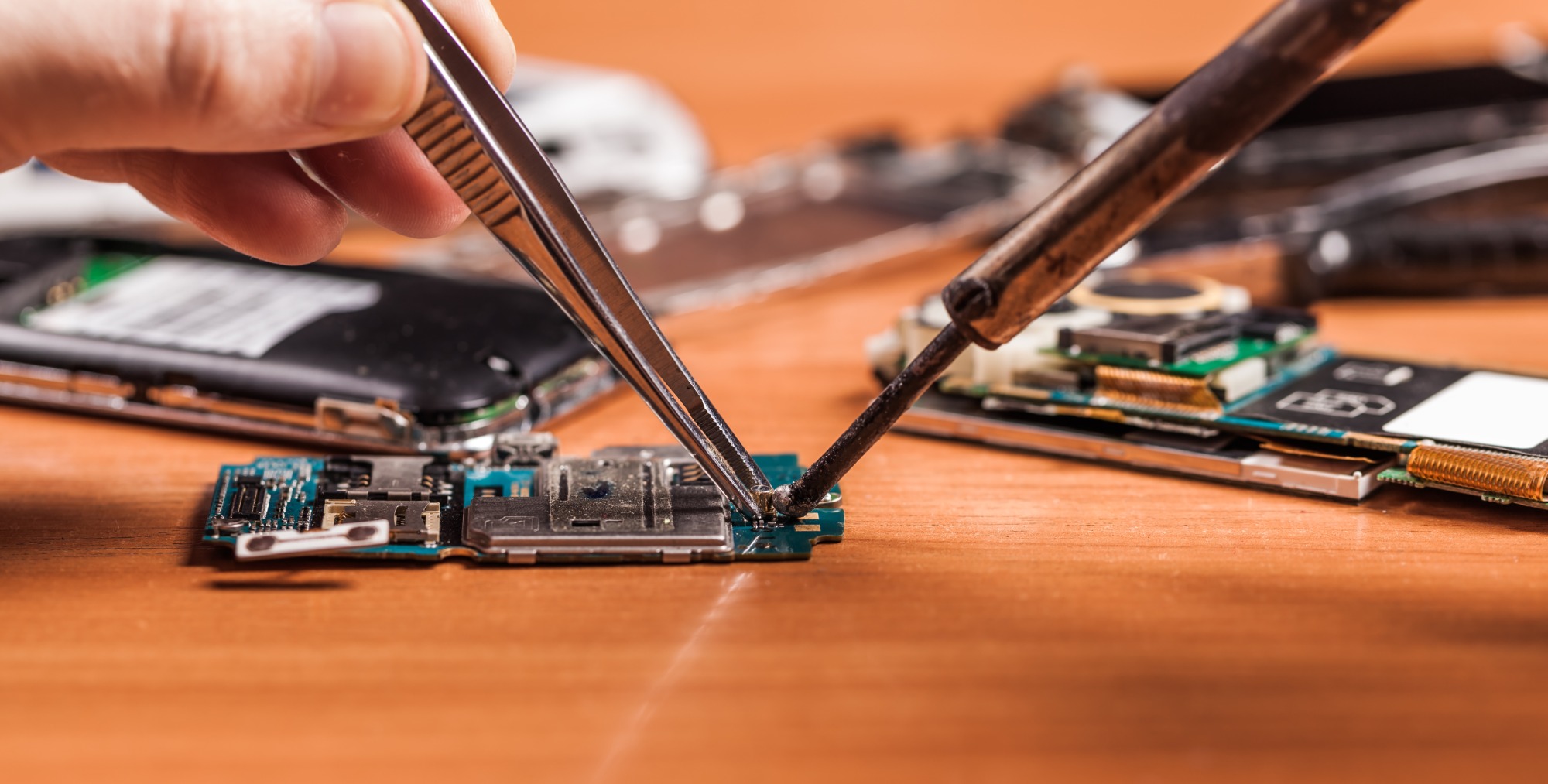

- 730+ tech repair stores nationwide. Most repairs done in 45 minutes or less

- Protection plans you can trust

- iPhone screen repairs starting at $79

- Our Best Service Plan at the Best Price!

- You're covered in the event of major system and appliance failures for a fraction of the average repair cost

- Receive Guaranteed Coverage & Protection

Understanding Home Warranties in the US

Owning a home is a significant investment, and with it comes the responsibility of maintenance and repairs. Homeowners often find themselves facing unexpected expenses when appliances or systems break down. This is where a home warranty can be a valuable asset. In the following section we'll explore everything you need to know about home warranties in the United States, from what they are and how they work, to their benefits and limitations.

Section 1: Understanding Home Warranties

What is a Home Warranty? A home warranty is a service contract designed to cover the repair or replacement costs of major home systems and appliances. It provides homeowners with peace of mind by mitigating the financial burden of unexpected breakdowns.

How Does a Home Warranty Differ from Homeowners Insurance? It's crucial to distinguish between a home warranty and homeowners insurance. While homeowners insurance covers damages caused by perils like fire, theft, or natural disasters, a home warranty focuses on the repair or replacement of covered appliances and systems due to normal wear and tear.

Section 2: Coverage

What Do Home Warranties Typically Cover? Home warranties typically cover essential home systems and appliances such as HVAC (heating, ventilation, and air conditioning), electrical systems, plumbing, kitchen appliances, and more. However, coverage can vary between providers, so it's essential to carefully review the terms of the warranty.

What Items Are Often Excluded from Coverage? Certain items are commonly excluded from home warranty coverage, such as pre-existing conditions, cosmetic issues, and components not explicitly mentioned in the contract. Additionally, coverage for specific high-end appliances or systems may require additional fees.

Section 3: How Home Warranties Work

Purchasing a Home Warranty

Homeowners can purchase a home warranty at any time, but it's often obtained either when buying a new home or when an existing warranty is about to expire. It's crucial to choose a reputable provider and thoroughly review the coverage options.

Coverage Period and Renewal

Home warranties typically have a one-year coverage period, but renewable options are available. Renewal may involve an increase in premiums, and homeowners should carefully assess whether continuing coverage is in their best interest.

Section 4: Benefits of Home Warranties

Financial Protection

One of the primary benefits of a home warranty is financial protection. Rather than facing high repair or replacement costs out of pocket, homeowners pay a relatively low annual premium and a service fee per claim, making budgeting for unexpected expenses more manageable.

Peace of Mind

Home warranties provide peace of mind by ensuring that essential home systems and appliances are covered. This can be particularly valuable for first-time homeowners or those with older homes where the risk of breakdowns is higher.

Convenience

Home warranty providers typically have a network of pre-screened service technicians. When a covered item malfunctions, homeowners can contact the warranty company, which will arrange for a service technician to assess and repair the issue.

Section 5: Limitations and Considerations

Coverage Limits

Home warranties often have coverage limits, meaning there is a maximum amount the warranty will pay for repairs or replacements. Homeowners should be aware of these limits and understand how they may impact their out-of-pocket expenses.

Pre-Existing Conditions

Most home warranties do not cover pre-existing conditions, emphasizing the importance of thoroughly inspecting a property before purchasing a warranty. Issues discovered after the coverage period begins may not be eligible for repair or replacement.

Service Call Fees

Homeowners are usually responsible for a service call fee, which is paid directly to the service technician upon their visit. These fees can vary, so it's essential to factor them into the overall cost of the home warranty.

Section 6: Selecting a Home Warranty Provider

- Step 1: Reputation and Reviews - When choosing a home warranty provider, it's crucial to research and consider their reputation. Reading reviews from other homeowners can provide valuable insights into the company's customer service, claim resolution, and overall satisfaction.

- Step 2: Coverage Options - Different providers offer various coverage options, ranging from basic plans covering essential systems to comprehensive plans including appliances. Homeowners should carefully evaluate their needs and choose a plan that aligns with their priorities and budget.

- Step 3: Contract Terms and Conditions - Before signing a home warranty contract, it's essential to read and understand the terms and conditions. Pay attention to coverage details, exclusions, and any additional fees. If there are unclear terms, seek clarification from the provider.

Section 7: Making a Claim

Reporting a Problem: When a covered item malfunctions, homeowners should promptly contact their home warranty provider to initiate the claims process. Some providers offer online portals or mobile apps for convenient reporting.

Service Technicians: The warranty company will typically assign a service technician to assess and repair the issue. It's important to communicate effectively with the technician, providing details about the problem and any relevant information about the covered item.

Approval and Resolution: After the technician assesses the issue, the home warranty provider will determine whether the repair or replacement is covered. If approved, the provider will coordinate and cover the costs, and the homeowner is responsible for the service call fee.

In conclusion, a home warranty can be a valuable tool for homeowners looking to protect their investment and manage the costs of unexpected repairs. Understanding the coverage, limitations, and how the claims process works is crucial for making an informed decision. As with any financial commitment, it's essential to research and choose a reputable provider that aligns with your specific needs. By doing so, you can enjoy the peace of mind that comes with knowing your home is covered in the event of unexpected breakdowns.

-1356d3a01e6a.png)

-1fa4d489448b.png)